Why are credit scores so important?

If you're embarking on the journey of finding a new home, particularly if you're a first-time buyer, there's a multitude of considerations to keep in mind—especially when it comes to financial responsibilities and the loan application process. One of the pivotal factors that lenders evaluate right from the start is your credit score. But why is this so crucial? It's because your personal credit score serves as a key indicator for lenders to assess whether you represent a reliable borrower, which directly correlates to your ability to secure and repay a loan.

Higher credit scores signal to lenders that you consistently make prudent financial decisions. Your credit report results further bolster their confidence that you can shoulder the long-term commitments associated with purchasing and owning a home. This entails the capability to smoothly transition from renting to managing monthly mortgage payments, property taxes, homeowner's insurance, and all the responsibilities that come with homeownership.

How does your credit score influence your home loan?The higher your credit score, the lower your interest rate tends to be, and conversely, a lower credit score typically results in a higher interest rate. Therefore, when it comes to securing a more favorable loan, the higher your credit score, the better.

It's essential to bear in mind that lenders scrutinize your payment history, the amount of debt you've accumulated, the length of your credit history, any recent credit or credit inquiries, and the type of credit cards you hold.

Useful advice for first-time homebuyers.According to mortgage loan experts, if you're gearing up to purchase your first home, it's vital to ensure your financial situation is in order. This entails consistently paying all your bills on time and avoiding taking on excessive debt immediately before or during the home-buying process. Lenders want to see that you have sufficient financial room to manage your monthly mortgage payment.

While it's natural to contemplate purchasing furniture and other significant items for your new home, it's advisable to exercise prudence and wait until after closing escrow. Making substantial purchases with a credit card, such as furniture (or a new car), can potentially have adverse effects on your credit score. Keep in mind that lenders will be monitoring your credit throughout the entire loan process until the very end, so it's important to exercise patience—your beautiful new home is well worth the effort!

Is it possible to qualify for a loan with a credit score in the 600s?Although FICO scores range from 300 to 850, there are numerous variables to consider when determining loan eligibility. Factors such as employment, income stability, and debt-to-income ratios all play a significant role. It's worth noting that there are a wide variety of loan programs and options designed to accommodate borrowers with varying FICO scores. With that in mind, it is indeed possible to qualify for a loan with a credit score around 600 and above.

Given that everyone's financial circumstances are unique, the best course of action is to consult with E&A Enterprises LLC Home Loans®.* A highly experienced mortgage loan officer can provide expert guidance and assist you at every stage to secure a loan that aligns with your individual priorities.

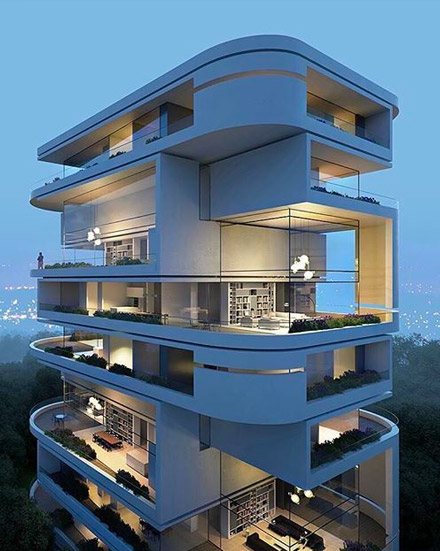

Maintaining your focus on the personal goal of homeownership.Purchasing a home, especially if it's your first, represents one of the most significant and exciting decisions you'll ever make. Undoubtedly, your credit history and financial aspects will be under scrutiny. However, it's important to remember that this is just one facet of the process, and before you know it, you'll be moving into and furnishing the new home you've always envisioned.